National Multifamily Report – November 2025

The U.S. multifamily market has witnessed its advertised rents dropping for the fourth consecutive month, according to Yardi Matrix’s latest survey of 140 markets. Rates dropped $8 in November to $1,740, continuing a slowing pattern. However, the yearly rental change was still positive at 0.2 percent, which admittedly marked the lowest level since 2021’s first quarter. The build-to-rent segment struggled both in the short and long term, with rates down $10 to $2,185 in November, marking a 0.5 percent downturn year-over-year.

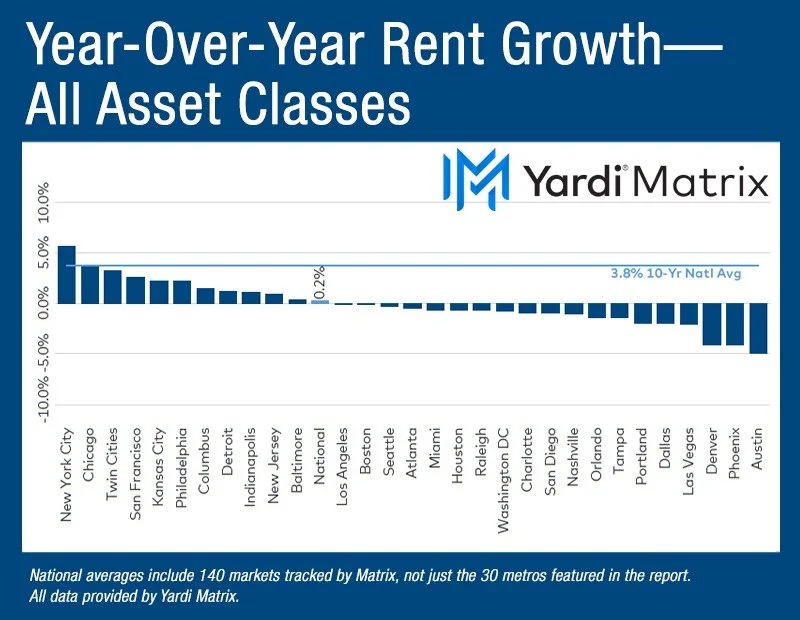

Roughly 60 percent of Yardi Matrix’s top 30 markets registered negative yearly rent growth. Coastal and Midwest metros bucked national trends, registering the highest rate increases, such as New York (5.7 percent), Chicago (3.8 percent), Twin Cities (3.2 percent), San Francisco (2.6 percent) and Kansas City, Mo. (2.2 percent). Supply-burdened markets continued experiencing rental decline, led by Austin (-5 percent), Phoenix and Denver (-4.1 percent each), as well as Las Vegas (-2.1 percent) and Dallas (-2.0 percent). Occupancy rates held steady at 94.7 percent in October, unmoved year-over-year; however, the monthly absorption was the weakest in several years.

Multifamily and BTR short-term losses compound

Short-term advertised rent movement reflected a visible market moderation as just one of the top 30 metros posted positive growth. The national rate ticked down 0.5 percent with a nearly uniform decline across Lifestyle assets (-0.5 percent) and Renter-by-Necessity (-0.4 percent). While high-supply metros led recent negative rent movements, November’s figures revealed strong yearly performers, such as New York and New Jersey, registering significant monthly declines. The sole exception was Twin Cities, which registered a 0.5 percent increase.

As Opportunity Zones become permanently enshrined into law, institutional investors may reconsider their approach to such developments. Since 2017, some $350 billion have been invested across OZs, mostly by middle-market entities. Yet, the volume could balloon faster with this bill, which will also redraw the tracts and reduce qualifying thresholds from 100 to 50 percent of a property’s basis. With multifamily being the most common OZ investment type, analysts believe more than 1 million housing units will debut within OZs across the next decade. For reference, nearly 600,000 units came online across OZs since 2018, of which, according to the Economic Innovation Group, half were developed directly as a result of the incentive.

Single-family build-to-rent advertised asking rents ticked down $10 to $2,185 in November, representing a 0.5 percent decline year-over-year—the largest decrease in more than a decade. Occupancy levels remained solid at 95.0 percent in October, marking a 10-basis point increase compared to last year. The Midwest registered the strongest gains with Chicago and the Twin Cities (7.9 percent each), while the Sun Belt continues recording the steepest losses, led by Austin (-3.9 percent), Charleston, S.C. (-3.8 percent) and Pensacola, Fla. (-2.5 percent).

Read the full Yardi Matrix multifamily real estate report.